FEDERAL TAX CREDITS

What is the Inflation Reduction Act

To help reduce the effects of inflation, the U.S. Government has passed the Inflation Reduction Act of 2022. The act includes federal tax credits for the installation of qualifying high-efficiency, ENERGY STAR® certified heating and cooling products.

THERE’S NEVER BEEN A BETTER TIME

TO UPGRADE YOUR HVAC SYSTEM.

Our highest-efficiency heating and cooling systems offer several homeowner benefits. From increased energy efficiency, to advanced comfort-enhancing capabilities, what’s not to like? And now, thanks to Uncle Sam: you can save like never before.

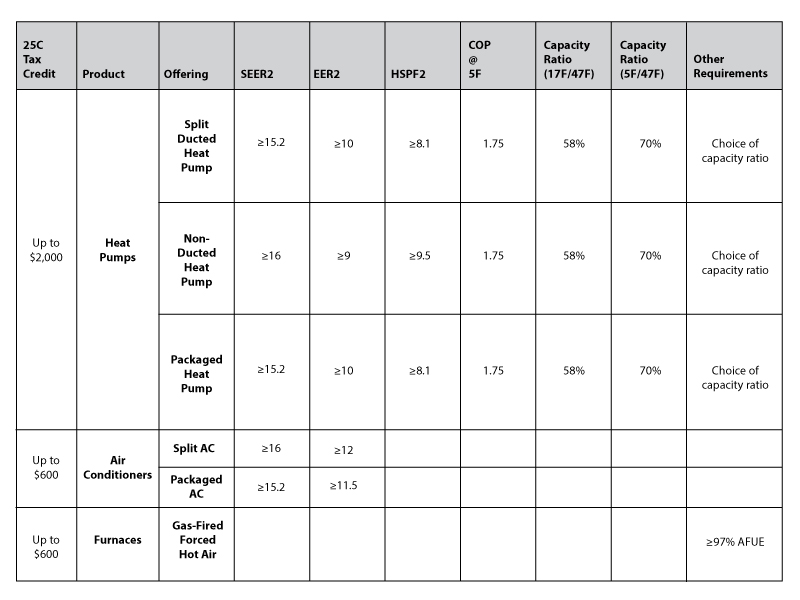

Tax Section 25C, Nonbusiness Energy Property Credit

Effective Jan 1, 2023: Provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $600 for qualified air conditioners and furnaces, and a maximum of $2,000 for qualified heat pumps.

*Subject to change: While the 2023 benefits of Section 25C are known for the 2023 tax year and beyond, the criteria to qualify for credit(s) are not yet finalized by the IRS and the above is subject to change based on whether the IRS will adopt the full CEE Criteria.

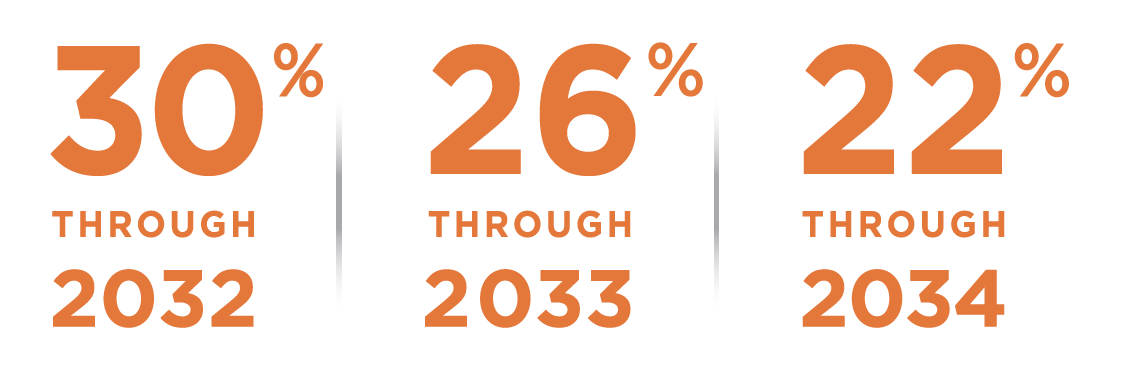

Geothermal Tax Credits Extended Through 2032

The 30% federal tax credit was extended through 2032 and will drop to 26% in 2033 and to 22% in 2034 before expiring altogether, so act now for the most savings!